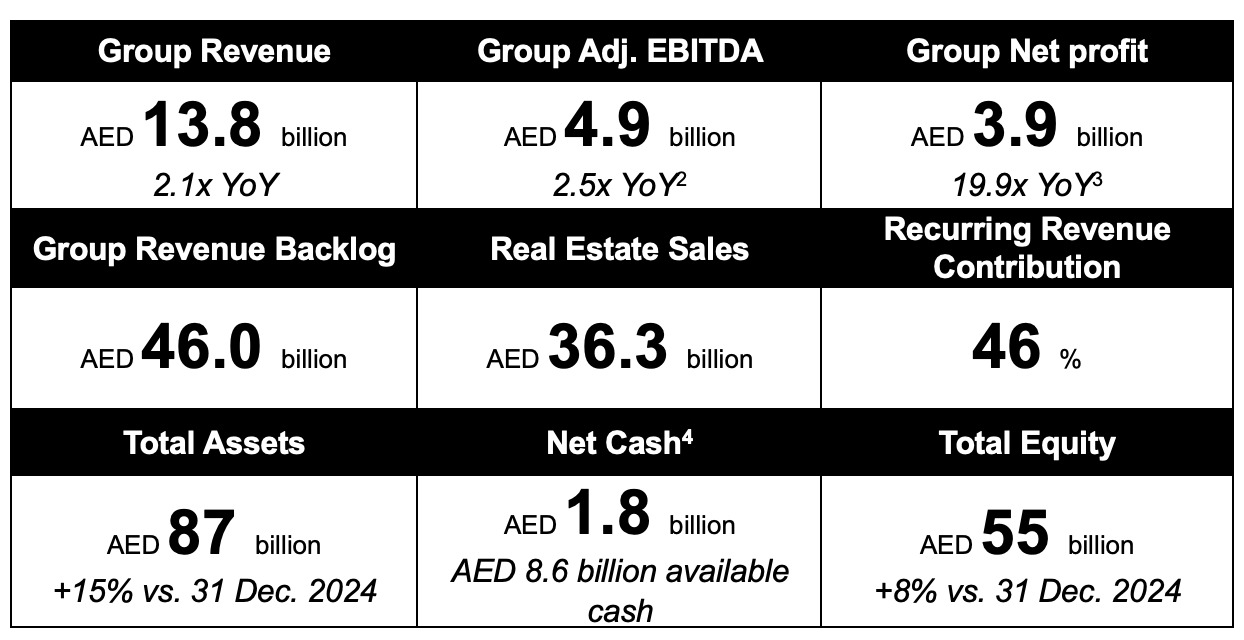

- Group revenue exceeded AED 13.8 billion, a 2.1x increase in comparison to last year, driven by strong portfolio performance, with real estate as the primary growth engine

- Group net profit exceeded AED 3.9 billion, representing a 19.9x year-on-year increase excluding prior-year one-off bargain gain, outpacing revenue growth and reflecting strong efficiency gains across core segments

- Real estate sales grew 2.8x versus last year, reaching AED 36.3 billion, including AED 29.8 billion in Abu Dhabi

- Group revenue backlog reached AED 46.0 billion, representing a 1.8x year-on-year increase, reinforcing forward earnings visibility and sustained growth

- Recurring income streams recorded strong growth, supported by robust performance across Asset & Investment Management, Hospitality, Events, Catering & Tourism segments

Abu Dhabi, UAE, 18 February 2026: Modon Holding PSC (“Modon”) delivered exceptional financial performance for the full year 2025, reporting revenue of AED 13.8 billion and net profit of AED 3.9 billion, reflecting a robust operating model and an accelerated execution of its strategy. The Group achieved significant year-on-year growth in revenue and profitability on a comparable basis, excluding prior year one-off items.

2025 marked Modon’s first full year of consolidated results following its formation in February 2024. During 2025, L’imad Holding Company, wholly owned by the Abu Dhabi Government, acquired an 84.75% ownership stake in Modon Holding. Supported by a stronger and more sustainable corporate and financial backing, this strategic step strengthened the Group’s institutional foundation, accelerated delivery of its strategy, and enhanced its ability to achieve ambitious targets more efficiently.

In this period, the Group accelerated delivery of its strategy for bringing cities to life – integrating urban destinations with sustainable communities, underpinned by an operating model that combines development, investment, and operations across its core business segments – reinforcing its foundations for sustainable growth and enhancing the Group’s long-term earnings visibility.

Real Estate led the Group’s growth during the year, underscored by record sales of AED 36.3 billion, supported by a strong business model and the effectiveness of its investment-led approach. This performance reinforces sustainable growth and enhances long-term value for shareholders, underpinned by continued progress against an integrated strategic vision focused on diversifying recurring income streams across core growth platforms, including Asset & Investment Management, Hospitality, Events, Catering & Tourism.

During the year, Modon advanced key Abu Dhabi developments, notably on Reem Island and the Hudayriyat Island masterplan, delivering successive launches, repeat sell-outs in record time, and ongoing construction progress, while continuing to advance the Ras El Hekma destination in Egypt. Group revenue backlog stood at AED 46.0 billion, reinforcing forward earnings visibility and providing a strong foundation for sustained growth.

FY 2025 Group Highlights

- Group revenue exceeded AED 13.8 billion, a 2.1x year-on-year increase, driven by the recognition of a deepening development backlog, improved performance across recurring revenue platforms, and contributions from strategic acquisitions.

- Group Adjusted EBITDA reached AED 4.9 billion, rising 2.5x year-on-year, with margins expanding by 521bps to 35.2%. Group net profit outpaced revenue growth, reaching AED 3.9 billion, up 19.9x year-on-year excluding prior-year one-off bargain purchase gain, reflecting strong operating performance across all core business segments.

- The Group closed the year with a net cash position of AED 1.8 billion, reflecting a well-capitalised balance sheet to support the development pipeline and strategic expansion agenda, while maintaining disciplined capital structure targets.

- Group revenue backlog stood at AED 46.0 billion, up 1.8x year-on-year, with development sales accounting for 93%, providing strong forward earnings visibility.

- Real Estate sales reached AED 36.3 billion across Abu Dhabi, Egypt and Spain, supported by rapid sell-outs of new launches in Abu Dhabi and for Wadi Yemm, the first district at Ras El Hekma, Egypt.

- Asset & Investment Management and Hospitality enhanced income visibility, through higher rental yields, strong occupancy, and operational efficiency, supported by strategic expansion in the United Kingdom, the United States, and infrastructure-related platforms.

- Events, Catering & Tourism delivered strong growth, driven by record-breaking activity levels, operational expansion, and strategic acquisitions, including Arena Group, as well as the full-year impact of the consolidation of Business Design Centre (UK) and Royal Catering.

H.E. Jassem Mohamed Bu Ataba Al Zaabi

Chairman of Modon Holding

“Building on the sustained growth momentum of recent years, 2025 marked a new phase of accelerated strategic transformation for Modon, mobilising an integrated business platform aligned across development, investment, and asset management. This approach strengthened the Group’s institutional readiness to capture high-value opportunities across both local and international markets, while expanding its global footprint in line with strategic priorities and an ambitious long-term vision.

Modon’s 2025 achievements reflect a clarity of strategic direction and a growing ability to translate vision into sustainable economic value. This is being realised through the development of fully integrated urban ecosystems, improved capital allocation efficiency, and enhanced resilience and sustainability of future cash flows.

Aligned with Abu Dhabi’s ambitious long-term agenda, Modon continues to ensure its strategy supports the emirate’s broader economic development objectives, with a focus on deepening the developmental impact of its projects, expanding its ecosystem of strategic partnerships, and reinforcing its position as a global developer, operator, and investor capable of driving growth and delivering sustainable value.”

H.E. Abdullah Al Sahi

Group Managing Director of Modon Holding

“Modon Holding’s full-year 2025 results mark a clear step in delivering its long-term strategy, as the Group expanded its operations and further diversified its investment portfolio during a pivotal year of transition.

Building on an integrated platform across real estate, hospitality, asset and investment management, and events, catering, and tourism, Modon continued to develop integrated communities and destinations that translate development vision into sustainable economic value.

Supported by strong real estate performance in Abu Dhabi, Egypt, and Spain, alongside continued growth in recurring income businesses and disciplined international investments, Modon strengthened its operational platform and enhanced its ability to deliver sustainable value, reinforcing its position as a strategic partner driving quality growth across regional and global markets.”

Bill O'Regan

Group Chief Executive Officer of Modon Holding

“2025 was a year of delivery for Modon. Group Revenue exceeded AED 13.8 billion while net profit reached AED 3.9 billion, supported by record real estate sales of AED 36.3 billion, expanding recurring income, and a growing revenue backlog of AED 46.0 billion, providing robust forward earnings visibility.

Execution across flagship destinations, continued progress across international markets, and the integration of strategic acquisitions strengthened the quality and resilience of our earnings. As we enter 2026, Modon is well-positioned to build on this momentum, with a disciplined focus on delivery, value creation, and long-term growth.”

Business Performance by Segment

Modon recorded significant growth across its four key business segments:

Real Estate:

- Real Estate remained the Group’s primary earnings driver in 2025, with segment revenue rising 2.6x to AED 7.4 billion, driven by accelerated backlog recognition.

- Total real estate sales surged to AED 36.3 billion, growing 2.8x compared to 2024, across Abu Dhabi, Egypt, and Spain.

- Project execution accelerated, with a record AED 32.0 billion in construction and consulting contracts procured during the year.

- Flagship developments across Reem and Hudayriyat Islands delivered record real estate sales, driven by successive launches and rapid sell-outs during 2025, contributing to the highest sales value in Abu Dhabi’s market.

- Internationally, Modon progressed its real estate platform across priority markets. In Egypt, the initial launch at Ras El Hekma generated AED 5.8 billion in sales across 2,109 units. In Spain, La Zagaleta maintained strategic momentum through land plot sales, complemented by ancillary income from hospitality and golf operations, broadening Modon’s global real estate presence.

Asset & Investment Management:

- The segment strengthened income stability in 2025 across a diversified portfolio of residential, retail, commercial, staff accommodation, and leisure assets. Strong leasing performance and consistently high occupancy (97% across owned assets) supported growth, with revenue increasing 13.2% year-on-year to AED 655 million.

- Alongside stable operating performance, Modon continued to reposition its investment portfolio during the year, completing the majority of its legacy financial asset disposals and redeploying capital into strategic opportunities. Notable investments included international assets such as 2 Finsbury Avenue (London, UK), Wellington Lifestyle Partners (Florida, USA), Harborside 4 (New Jersey, USA), and expansion into infrastructure platforms, reinforcing the Group’s broader diversification strategy.

Hospitality:

- As of December 2025, the Hospitality segment comprised a portfolio of 7,137 keys across Abu Dhabi, Europe, and Africa, split between wholly owned, operated, and joint-venture hotels.

- The segment delivered steady operating performance during the year, supported by higher average daily rates and disciplined portfolio management.

- Revenue from the hotel portfolio increased 38.9% year-on-year to AED 792 million, driven by improved operational performance with occupancy averaging 71% and key pricing metrics strengthening.

- During the year, the Group announced Olympia Resort Abu Dhabi, a new active-lifestyle hospitality destination on Hudayriyat Island, supporting the continued growth of Modon’s hospitality offering.

- On 24 December, Modon agreed to divest its entire indirect shareholding in Icon Hotel Investment Ltd., supporting the Group’s ongoing transition towards an owner-operator model, subject to regulatory approvals.

Events, Catering & Tourism:

- The Events, Catering & Tourism segment delivered a strong performance in 2025, benefiting from increased scale, broader operational reach, and the contribution from strategic acquisitions. Segment revenue reached AED 5.01 billion, doubling year-on-year, reflecting the scale and global reach of the platform across Abu Dhabi, London, the United States, and other international markets.

- Activity levels hit record highs in 2025, with Modon hosting 896 events and attracting more than 6.3 million visitors across its venues. The Catering cluster served 51.6 million meals, driven by strong multi-channel demand.

- The segment also expanded its global capability from May 2025 through the consolidation of Arena Group, providing scalable infrastructure for world-class events.

Strategic Investments

2025 marked continued execution of Modon’s global expansion strategy through targeted investments and partnerships across real estate, infrastructure, events, and hospitality:

- 2 Finsbury Avenue (UK): Acquired a 50% equity interest in the 2 Finsbury Avenue development in London’s Broadgate district, marking Modon’s first direct exposure to UK prime commercial real estate.

- Arena Group: Completed the acquisition of 100% of Arena Events Group, a global provider of large-scale event infrastructure and modular venues, significantly expanding Modon’s international events delivery capabilities and strengthening its presence in North America.

- Wellington Lifestyle Partners (USA): Made a strategic investment in Wellington Lifestyle Partners in the United States, marking Modon’s first direct investment in an equestrian-led lifestyle destination.

- Harborside 4 (USA): Entered a joint venture with Related Companies and Panepinto Properties to develop Harborside 4, a luxury residential tower in Jersey City, New Jersey, establishing a presence in a key US residential market.

Outlook & Future Growth

Modon enters 2026 with strong momentum and a clear focus on disciplined execution, underpinned by a diversified operating platform and a growing recurring income base. The Group’s full-year performance reflects its ability to translate scale into delivery, supported by a high-visibility development backlog, an expanding international footprint, and resilient income streams.

Looking ahead, Modon remains focused on advancing delivery across its portfolio of destinations, converting its AED 46.0 billion backlog into revenue while maintaining construction momentum across key destinations. Continued activation of Modon’s recurring income portfolio across asset & investment management, hospitality, and events is expected to further strengthen earnings visibility and capital efficiency.

Supported by a strong balance sheet and disciplined capital deployment, Modon is well positioned to pursue high-growth opportunities across priority international markets, infrastructure, and experiential platforms. In parallel, continued progress in digital enablement and sustainability practices will support operational efficiency and responsible growth, reinforcing Modon’s role as an integrated city builder and operator in support of Abu Dhabi’s long-term urban development agenda.